Table Of Content

Private mortgage insurance (PMI) is required for borrowers of conventional loans with a down payment of less than 20%.PMI typically costs between .05% to 1% of the entire loan amount. Although PMI raises your monthly payment, it may allow you to purchase a home sooner, which means you can begin earning equity. It’s important to speak to your lender about the terms of your PMI before making a final decision. All monthly payment amounts above assume on time monthly payments each month for the full duration of the loan term (e.g. 360 monthly payments for a 30 year loan). Displayed monthly payment amounts do not include amounts for property taxes and hazard insurance.

Start your home buying research with a mortgage calculator

Work with a lender to find the right loan for the home you love. If you haven’t already, use the How Much House Can I Afford Calculator at the top of the page to get a good estimate of the amount you should spend. Learn Dave Ramsey’s roadmap to buy, sell and invest in real estate the right way, so your home can be a blessing, not a burden. Along the same lines of thinking, you might consider holding off on buying the house. Let's take a look at a few hypothetical homebuyers and houses to see who can afford what. A financial advisor can aid you in planning for the purchase of a home.

How Much House Can I Afford On A $120K Salary? - Bankrate.com

How Much House Can I Afford On A $120K Salary?.

Posted: Tue, 03 Oct 2023 07:00:00 GMT [source]

Income

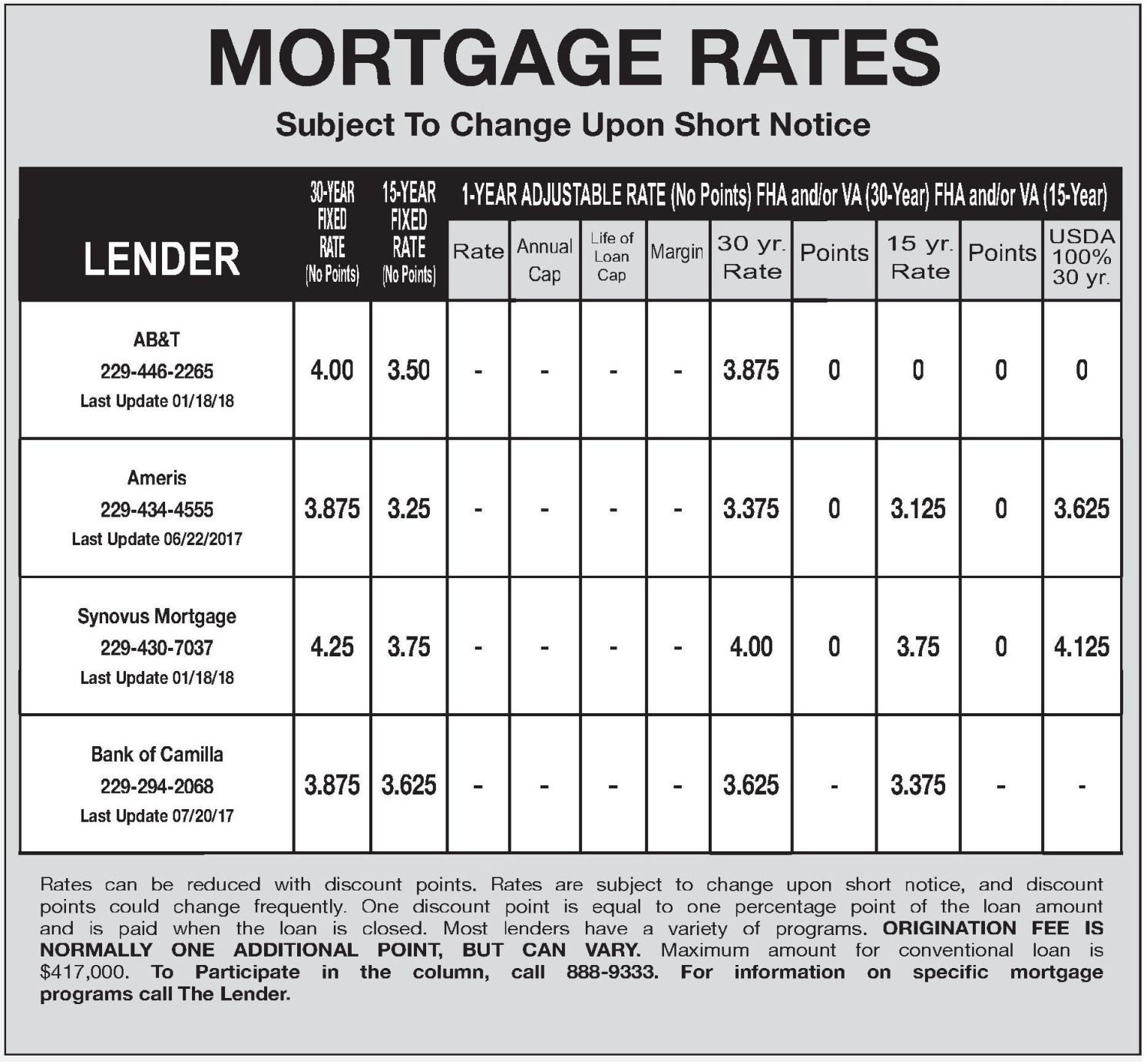

Check out this guide for the different methods for determining how much of your income should go to your mortgage. The rule of thumb is to meet with at least three lenders to compare mortgage rates but five is often preferred. The more quotes you get, the greater possibility that you can save thousands of dollars over the life of your loan. Explore mortgage options to fit your purchasing scenario and save money. Fixed-rate loans have the same interest rate for the entire duration of the loan. That means your monthly home payment will be the same, even for long-term loans, such as 30-year fixed-rate mortgages.

Faster, easier mortgage lending

You might not spend this amount each year, but you’ll spend it eventually. This formula will come in handy when determining how much home you can afford. Annual income is the amount of documented income you earn each year.

Non-conforming loans are not limited to the size limit of conforming loans, like a jumbo loan, or the guidelines like government-backed loans, although lenders will have their own criteria. We'll send you disclosures listing your loan terms as well as estimated payments, and your application will be reviewed by an underwriter. Equally, the lower the interest rate you can get the less you’ll pay each month against your mortgage as well as over the life of the loan. Below are some hypothetical examples of how slight differences in your APR(%) can impact what you pay against your mortgage.

It’s enough to make you wonder whether now is even a good time to buy a house. It’s important to focus on your personal situation rather than thinking about the overall real estate market. Is your credit score in great shape, and is your overall debt load manageable?

How does the type of home loan impact affordability?

If making a large down payment would erase your financial reserves for future emergencies, then this is not a good idea. Most lenders want you to have a credit score of at least 620 to get a conventional loan. However, it is possible to get a mortgage with a bad credit score, but you will have to put more money down or pay a higher interest rate.

Laws vary by state but, as a general rule, your homeowners insurance policy must be big enough to cover the cost of rebuilding your home as-is. Most areas have down payment assistance programs to help borrowers come up with the cash to purchase their own homes. Conventional and FHA loans allow borrowers to use down payment money given by a close friend or relative. A down payment is the amount of your own money you pay upfront to buy a new home. Your down payment, combined with the loan amount, will cover the entire purchase price. Sometimes known as “loan term,” the length of the loan is the number of years until your home loan is paid in full.

Once you’ve done all that, it’s time to go after that perfect home. All three government-backed loans have mortgage limits, which is a handy way to help you stay in a healthy debt-budget range. Assessing how much you should spend on a house requires a bit of a look into your current and potentially future financial situation. Before you take on the maximum loan you can get and start looking at more expensive houses, consider these tips. If you have a VA loan, guaranteed by the Department of Veterans Affairs, you won’t have to put anything down or pay for mortgage insurance, but you will have to pay a funding fee. Some homes are in a special flood hazard area; this means you’ll probably be required to buy flood insurance.

A key step in figuring out how much you’re able to spend on a home is applying for a mortgage. Start the mortgage application process with Rocket Mortgage today. Here are answers to a few frequently asked questions about calculating home affordability so you can better understand your buying power.

They’ll cost 0.17% to 1.86% per year per $100,000 you borrow, or $35 to $372 per month on a $250,000 loan. Homeowners insurance costs more in places where homeowners file more claims. A local insurance agent might be happy to give you an idea about prices in the area since you could become a future client. If you just want to ballpark it, the national average annual premium for a $250,000 home is about $1,100 (about $92/month). If you can’t afford to pay cash for a house, you’re likely going to need a mortgage.

The loan does not require any down payment, and unlike other loans, it also does not require private mortgage insurance. But, think of it this way, you’ll improve your chances for a favorable mortgage, which is usually 30 years of your life. Waiting a few years to put yourself in a better position is just a fraction of time compared to the many years you’ll spend paying your monthly mortgage bill. Even though Martin can technically afford House #2 and Teresa can technically afford House #3, both of them may decide not to.

Debt-to-income thresholds in the calculator are based on interviews with mortgage brokers on what they generally see in the marketplace. Now that you have your estimated home price, check out different loan options with our Mortgage Calculator. Financial planners often mention the “28/36 rule” when it comes to home affordability. The higher your down payment, the higher the loan amount you can qualify for.

No comments:

Post a Comment